This Wednesday, July 12th, 2023 the Hamilton Southeastern School board is doing a joint meeting with the Fishers mayor and city council. The expectation is that everyone will agree to the approval of a resolution to place the school operating referendum on the November ballot. This approval does not enact the referendum, but simply makes it possible for the public to vote to determine if it will happen. There is really no reason for the HSE board to not approve this action as it simply gives the power to the people to determine how things will progress.

It is important to understand that this referendum is not a new tax. Rather, an existing referendum approved in 2016 will be ending, so this simply renews it. This means there is no new tax increase. In fact, the HSE administration is recommending a decrease in the tax rate that currently is in place. This means that if all else stayed the same, tax bills for those under the state tax cap would actually go down.

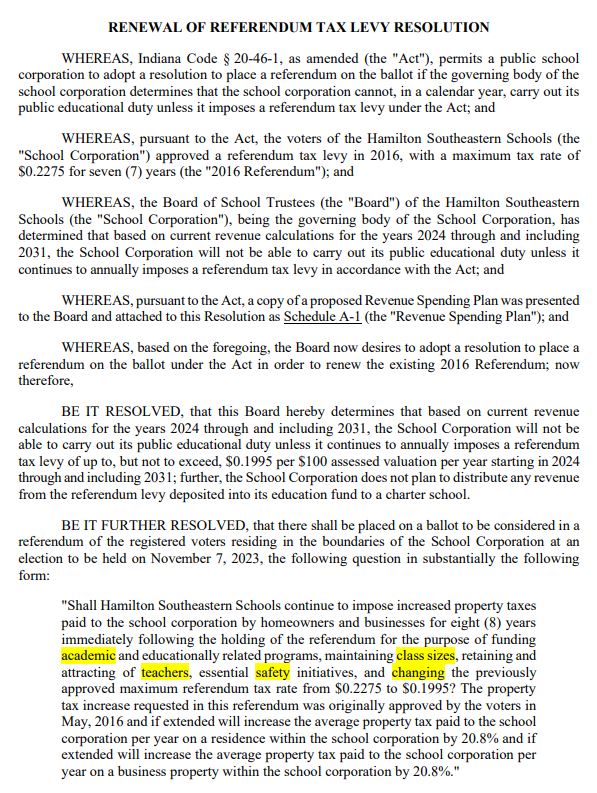

If the board approves this, which is expected, then the proposed language for the ballot in November would e the following:

“Shall Hamilton Southeastern Schools continue to impose increased property taxes

paid to the school corporation by homeowners and businesses for eight (8) years

immediately following the holding of the referendum for the purpose of funding

academic and educationally related programs, maintaining class sizes, retaining and

attracting of teachers, essential safety initiatives, and changing the previously

approved maximum referendum tax rate from $0.2275 to $0.1995? The property

tax increase requested in this referendum was originally approved by the voters in

May, 2016 and if extended will increase the average property tax paid to the school

corporation per year on a residence within the school corporation by 20.8% and if

extended will increase the average property tax paid to the school corporation per

year on a business property within the school corporation by 20.8%.”

Most of this wording is dictated by the state. For example, even though this will equate to a decrease in the tax rate, the state requires the word increase to be used in the ballot statement. For this reason, HSE has tried to be clear in showing that the existing rate of .2275 will change to .1995, which is clearly a decrease.

It is also worth noting that if approved, this is the maximum referendum rate that the district will charge. The public will have approved this rate, so the school district will be able to include that amount in their budgeting. The district can, however, charge a lower rate. If home assessed values continue to climb at crazy rates, the district can reduce the referendum rate in a given year to reduce the burden on tax payers. It is also worth noting that if this rate is approved, it will be in place for eight years.

The district has stated specific purpose for using the funds from the referendum. In the ballot wording, it states “The purpose of funding academic and educationally related programs, maintaining class sizes, retaining and attracting of teachers, essential safety initiatives”. The following is how it a little more specific on how the money is expected to be spent.

- Funding academic and educationally related programs. Includes approximately 67 certified teachers. – $ 6,700,000

- Maintaining class sizes. Includes approximately 59 certified teachers – $ 5,900,000

- Retaining and attracting of teachers. Maintaining competitive salary and benefits for certified staff members. – $ 9,000,000

- Essential safety initiatives Includes training and support for current Director of School Safety and approximately 22 School Resource Officers. – $ 2,400,00

These targets and dollar amounts are based on current net assessed values and are subject to change. The same is true with the targets, which is that they could adjust each year as well. The assessed values are expected to grow at roughly 6.2% each year.

In a previous school board meeting, the board members voted on their intent to move forward with considering the referendum. As mentioned, the board simply approves putting the referendum on the ballot. They don’t approve the referendum – the public does that with a vote in November. As such, there is little reason for a board member to not move forward with this action.

Were they to turn down this action, or if the public voted to drop the referendum in November, there would be an impact on the school district. Most notably, more than $25,000,000 would be lost from the budget. While there are those that have suggested cutting admin roles and other costs, most of those don’t come close to offsetting $25 million. For example, the five contracts that were questioned at the previous board meeting would equate to less than 4% of that amount. Cutting a hundred thousand here and a million there is a start, but it takes a lot of cutting to save $25 million. As such, it is considered important for this referendum if the same level of class size and academic excellence is to be maintained.

The board is expected to approve this at a meeting tomorrow. The city leadership is expected to stand behind and support the board in this action as well. The schools are one of the top assets — if not the top asset — of Fishers, so maintaining the investment in their excellence is critical for the community.

# # #